Navigating the complexities of financial management can be daunting for many businesses, especially small to mid-sized enterprises. Outsourced CFO services offer a cost-effective solution, providing expert financial guidance without the burden of a full-time hire. Whether you’re looking to optimize cash flow, enhance profitability, or ensure accurate financial reporting, an outsourced CFO’s services can be a game-changer for your business.

What is an Outsourced CFO?

An outsourced CFO may significantly improve your financial decision-making process. The CFO function can help you streamline your financial operations. An outsourced CFO is a financial expert who provides high-level CFO services on a part-time, remote, or contract basis. Unlike an in-house chief financial officer, an outsourced CFO offers flexibility and specialized skills tailored to your specific business needs. This approach allows companies to access top-tier financial expertise without committing to a full-time salary.

Definition and Roles of an Outsourced CFO

The primary role of an outsourced CFO is to deliver strategic financial leadership, manage cash flow, and oversee financial reporting. They work closely with your management team and bookkeeper to develop financial strategies that drive growth and improve overall financial health. For more information about the full range of services, visit our advisory page to learn about our CFO consulting.

Comparison with In-House CFO

While an in-house CFO can provide day-to-day financial oversight, the cost of hiring a full-time executive can be prohibitive for many businesses, but an outsourced CFO may be able to offer a more viable option. In contrast, an outsourced CFO offers the same level of expertise at a fraction of the cost, making it an efficient solution for growing companies. This flexibility allows you to scale outsourced financial services up or down based on your company’s evolving needs.

For a detailed consultation on how outsourced CFO services can benefit your business, consider scheduling an appointment with our Founder and Principal CPA, Ian Borbolla, an expert in virtual CFO services.

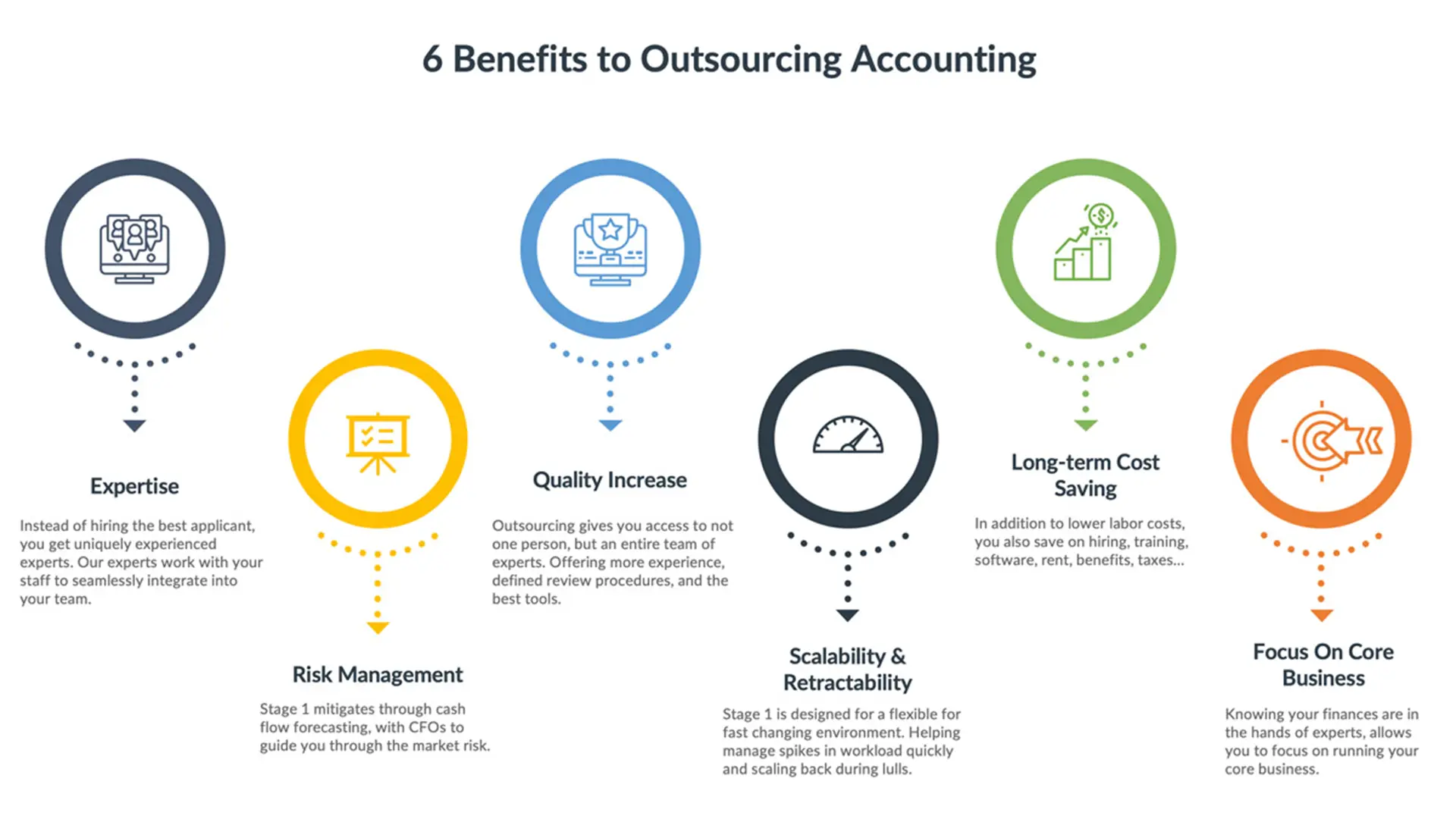

Benefits of Outsourcing Your CFO

Cost-Effective Financial Management

Hiring an outsourced CFO is a cost-effective solution for accessing expert financial management. It eliminates the need for a high-salary in-house CFO, allowing you to allocate resources more efficiently, without a CFO on your full-time payroll.

Access to Financial Expertise

An outsourced CFO brings a wealth of financial expertise to your organization, providing insights that can significantly impact your business’s financial health. Their experience spans various industries, ensuring they can address diverse accounting needs.

Key Services Provided by Outsourced CFO Firms

Strategic Financial Planning

One of the primary services provided by an outsourced CFO is strategic financial planning. This involves creating a long-term financial strategy that aligns with your business goals. Whether you’re a small business owner or a venture capital firm, an outsourced CFO can help you develop a comprehensive budget and forecast to guide your financial decisions. This proactive approach ensures that your business is prepared for future growth and can navigate financial challenges effectively through the assistance of fractional CFOs.

Cash Flow Management

Effective cash flow management is crucial for the sustainability of any business. An outsourced CFO will provide expert guidance on optimizing cash flow to ensure your business remains solvent and can meet its financial obligations, the finance team oversees all accounting and finance matters. By managing working capital efficiently, they help maintain a healthy balance between incoming and outgoing funds, which is vital for business growth. This includes monitoring financial statements and making adjustments as needed to improve profitability.

Financial Analysis and Insights

An outsourced CFO goes beyond just crunching numbers. They provide in-depth financial analysis and insights that help business owners understand their financial health. By analyzing key performance indicators (KPIs), they can identify areas for improvement and recommend strategies to enhance financial management. This level of analysis is crucial for businesses looking to make data-driven decisions and achieve long-term success and can be supported by fractional CFO services.

How Outsourced CFOs Support Business Growth

Assistance for Venture Capital and Private Equity Firms

Outsourced CFOs play a crucial role in supporting venture capital and private equity firms. They provide the necessary financial expertise to navigate funding rounds and ensure comprehensive financial due diligence. By working closely with investors, an outsourced CFO can help structure deals that align with both short-term and long-term business goals. This partnership is invaluable for business owners looking to secure investment and drive business growth.

Enhancing Operational Efficiency

Improving operational efficiency is a key benefit of engaging an outsourced CFO. These financial experts streamline accounting services, including bookkeeping, payroll, and financial reporting. By implementing effective financial controls and processes, helps reduce inefficiencies and minimize errors. This not only saves time and resources but also ensures that your financial management practices are robust and reliable.

Strategic Advisory for Business Owners

An outsourced CFO provides strategic advisory services that are tailored to the unique CFO needs of each business. They assist in defining clear financial strategies and offer insights that help business owners make informed decisions. Whether you’re planning a major expansion, navigating a financial downturn, or simply looking to improve profitability, an outsourced CFO offers the guidance needed to achieve your objectives.

To explore the full range of services and how an outsourced CFO can help your company, visit our outsourced services page for more information on how to hire a CFO for your business.

For a personalized consultation, schedule an appointment with our Founder and Principal CPA, Ian Borbolla, or Give us a call to discuss your needs.

Building a Collaborative CFO Team

Working with an outsourced CFO often involves building a collaborative CFO team that integrates seamlessly with your existing management team, providing financial expertise and strategic direction. This team-based approach ensures that all aspects of your finance and accounting are covered, from high-level strategic planning to day-to-day accounting needs. By leveraging the expertise of a team of financial experts, your business can achieve greater financial health and stability.

Selecting the Right Outsourced CFO Firm

Evaluating Expertise and Experience

When considering an outsourced CFO firm, it’s essential to evaluate their expertise and experience. Look for a team that has a proven track record of success in your industry. Their ability to understand the specific accounting needs and challenges of your business will ensure they can provide effective CFO services. A well-qualified outsourced CFO can help your company achieve its financial goals and navigate complex financial landscapes. By hiring a CFO, you can focus on your core business activities.

Understanding Service Offerings

Different outsourced CFO firms offer various levels of service, so it’s crucial to understand what each firm provides. Ensure they offer a full range of financial services, from strategic financial planning and cash flow management to financial reporting and compliance. Customized services tailored to your business needs can provide significant value, especially when you utilize the controller-level expertise of an outsourced CFO.

Conclusion

In today’s competitive business environment, having access to top-tier financial expertise is more critical than ever. Outsourced CFO services provide a flexible, cost-effective solution that allows businesses to benefit from the skills of a chief financial officer without the need for a full-time commitment. Whether you’re a small business looking to improve profitability or a venture capital firm seeking financial guidance, an outsourced CFO can offer the strategic insight and operational support you need.

Choosing the right outsourced CFO firm involves evaluating their expertise, understanding their service offerings, and building a collaborative CFO team to address your company’s CFO needs. By doing so, you can ensure that your business has the financial leadership required to thrive. To learn more about how our outsourced CFO services can benefit your business, consider scheduling an appointment with our Founder and Principal CPA, Ian Borbolla, or visit our advisory page.

Enhance your financial strategy today with the help of our dedicated team of financial experts, who provide financial solutions tailored to your company’s unique needs. Book a consultation here and take the first step towards improved financial management and business success.