Running a business in Miami, FL, is exciting and rewarding, but it also comes with its challenges. One of the most crucial aspects of maintaining a successful business is ensuring your financial records are accurate and up to date. This is where professional bookkeeping services come in. Whether you’re a small business owner or managing a larger enterprise, having a reliable bookkeeper can make all the difference in your financial health and compliance.

Understanding Bookkeeping Services in Miami

What is Bookkeeping?

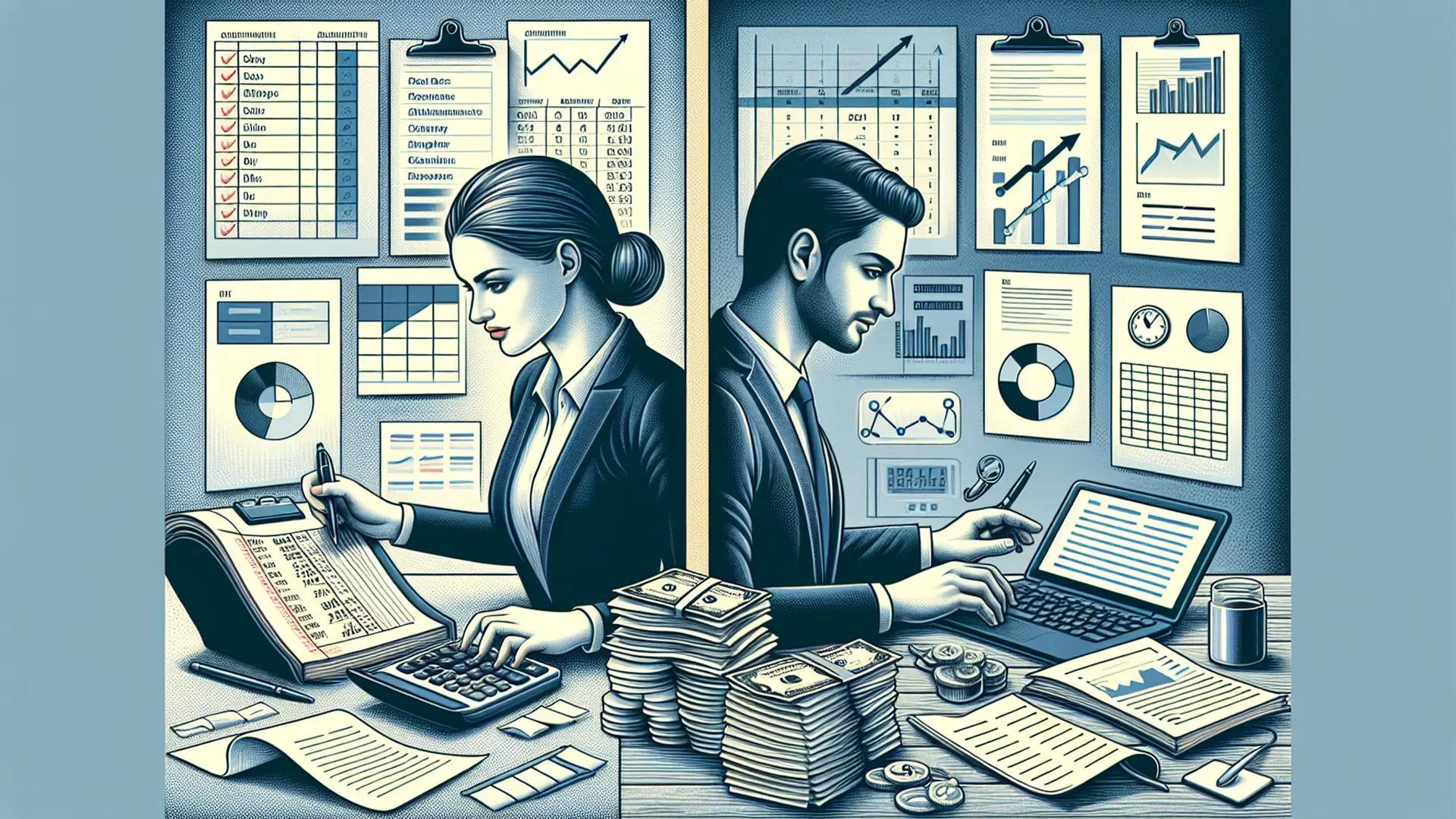

Bookkeeping is the process of recording and managing all financial transactions made by a business. This includes sales, purchases, receipts, payments, and tax preparation services. Effective bookkeeping ensures that these transactions are accurately logged in the company’s financial records. In the context of Bookkeeping Miami, while bookkeeping and accounting are often used interchangeably, they serve different purposes. Bookkeeping is primarily about maintaining accurate records, while accounting, including financial reporting, involves analyzing and interpreting these records to make informed business decisions.

Why Miami Businesses Need Bookkeeping Services

Miami-based businesses have unique needs that require specialized bookkeeping services. The dynamic economic environment and diverse business landscape in Miami make it essential to have a bookkeeper from an accounting firm who understands local market conditions. Professional bookkeeping services offer numerous benefits to small business owners, including:

- Improved Accuracy: Professional bookkeepers ensure that all financial records are precise and up to date.

- Time Savings: Outsourcing bookkeeping allows business owners to focus on core activities instead of managing financial records.

- Compliance: Staying compliant with local and federal tax laws is crucial for avoiding penalties and fines.

Key Bookkeeping Services in Miami, FL

Daily Bookkeeping

Daily bookkeeping involves the meticulous management of everyday financial transactions. This service ensures that sales, purchases, receipts, and payments are accurately recorded and reconciled. Here are some key aspects of daily bookkeeping:

- Recording Transactions: Accurate documentation of all financial transactions.

- Reconciliation: Ensuring that financial records match bank statements.

- Expense Tracking: Monitoring and categorizing business expenses.

Financial Statements Preparation

Preparing financial statements is a fundamental aspect of bookkeeping. These statements provide a comprehensive overview of a business’s financial health. The main financial statements include:

- Balance Sheets: A snapshot of a company’s assets, liabilities, and equity at a specific point in time.

- Income Statements: A summary of revenue, expenses, and profits over a period.

- Cash Flow Statements: An analysis of cash inflows and outflows, highlighting how cash is generated and spent.

Accurate financial statements are crucial for making informed business decisions and planning for future growth.

Payroll Services

Managing payroll is another essential bookkeeping service. Proper payroll management ensures employees are paid accurately and on time. Key components of payroll services include:

- Salary and Wage Calculation: Determining gross and net pay for employees.

- Tax Withholding: Deducting appropriate taxes and other deductions.

- Compliance: Ensuring adherence to federal and state payroll regulations.

Integrating payroll with bookkeeping processes maintains consistency and accuracy in financial records, which is vital for any business.

Tax Preparation and Filing

Tax preparation and filing are critical services that ensure businesses remain compliant with tax laws. Bookkeepers assist in preparing and filing taxes, ensuring all necessary documentation is in order. This service includes:

- Tax Planning: Strategizing to minimize tax liabilities.

- Tax Filing: Submitting required tax forms accurately and on time.

- Compliance: Keeping up-to-date with changes in tax laws to ensure compliance.

By handling tax preparation and filing, bookkeepers help businesses avoid penalties and stay compliant with tax regulations.

Outsourced Bookkeeping and Accounting

Outsourcing bookkeeping and accounting services can provide significant advantages for businesses in Miami. Outsourced services include:

- Cost Savings: Reducing the need for in-house staff and related expenses.

- Expertise: Access to professionals with extensive experience in bookkeeping and accounting.

- Focus on Core Activities: Allowing business owners to concentrate on growth and operations.

Outsourced bookkeeping helps manage cash flow effectively and provides detailed financial insights that support business decisions.

For a complete list of services offered by Digital Tax Group, visit our services page. Ready to streamline your bookkeeping with our Miami bookkeeping services? Schedule an appointment with us today!

Choosing the Best Bookkeeping Service in Miami

Qualities of Top Bookkeepers in Miami

When selecting a bookkeeping service, it’s important to consider several key qualities that distinguish top bookkeepers in Miami. These include:

- Experience in Bookkeeping: Look for bookkeepers with years of experience handling various financial tasks. This ensures they can manage your bookkeeping needs efficiently and accurately.

- Expertise with Accounting Software: Proficiency in accounting software like QuickBooks is crucial. This software helps streamline bookkeeping processes and ensures all financial data is accurately recorded.

- Certified Public Accountant (CPA): Choosing a bookkeeper who is also a CPA can provide added assurance of their expertise and professionalism. CPAs are well-versed in tax laws and financial regulations, making them valuable assets to any business.

Comparing Bookkeeping Firms

When comparing bookkeeping firms in Miami, consider the following factors:

- Cost: Evaluate the pricing structure of different firms. While it’s essential to find a service that fits your budget, remember that the cheapest option is not always the best. Balance cost with the quality of service provided.

- Services Offered: Ensure the firm offers a wide range of services that meet your business needs. This might include payroll services, tax preparation, financial statement preparation, and more.

- Customer Reviews: Look at reviews and testimonials from other business owners. This can provide insights into the firm’s reliability, professionalism, and customer satisfaction.

Benefits of Professional Bookkeeping Services

Accuracy and Efficiency

One of the primary benefits of professional bookkeeping services is the accuracy they bring to your financial records. Reducing errors in financial statements is critical for making sound business decisions. Professional bookkeepers ensure that all transactions are recorded accurately, and financial statements are prepared correctly.

Time-Saving

Outsourcing bookkeeping services saves time for business owners and allows them to focus on their core operations while utilizing our financial services. Managing financial records can be time-consuming and distract from core business activities. By outsourcing, business owners can focus on growing their business while bookkeepers handle the financial details.

Financial Insights

Professional bookkeepers provide valuable financial insights through detailed financial analysis and reporting. These insights help business owners make informed decisions, plan for the future, and understand their financial health.

Support and Consulting

In addition to managing financial records, professional bookkeepers often offer business consulting and advisory services. This support can be invaluable for business owners looking to optimize their operations and plan for growth.

Digital Tax Group: Your Trusted Bookkeeping Partner

About Digital Tax Group

Digital Tax Group stands out as a reliable partner for bookkeeping and accounting services in Miami. With a commitment to excellence and a deep understanding of the local business landscape, Digital Tax Group provides tailored solutions to meet the diverse needs of Miami-based businesses. Led by Ian Borbolla, Founder and Principal CPA, the firm combines expertise with personalized service to help clients achieve financial clarity and success.

Services Offered

Digital Tax Group offers a comprehensive suite of services designed to support business owners in managing their finances effectively. These services include:

- Bookkeeping: From daily transaction management to detailed reconciliations, our bookkeeping services ensure your financial records are accurate and up-to-date.

- Accounting Services: We provide a range of accounting services, including financial statement preparation, tax preparation, compliance, and payroll management.

- Tax Planning and Preparation: Our team stays abreast of the latest tax laws to offer strategic tax planning and ensure timely tax filing.

- Consulting and Advisory Services: We offer expert advice to help you make informed business decisions and achieve your financial goals.

How to Get Started

Embarking on a partnership with Digital Tax Group is straightforward. We are committed to making the process seamless for our clients. Here’s how you can get started:

- Schedule an Appointment: Visit our website to book a consultation at your convenience. Our team is ready to discuss your specific needs and how we can help.

- Call Us: For immediate assistance, call us at 786-707-3077 – contact us for expert financial services. Our friendly staff is here to answer your questions and provide your needed information.

- Explore Our Services: To understand more about what we offer, visit our comprehensive services page. We detail each service to help you determine which ones best suit your business needs.

Why Choose Digital Tax Group

Choosing the right bookkeeping and accounting partner can make a significant difference in your business’s financial health. Here’s why Digital Tax Group is the preferred choice for many Miami businesses:

- Expertise and Experience: With years of experience and a team of certified professionals, we provide top-notch bookkeeping, accounting, and tax preparation services.

- Customized Solutions: We understand that each business is unique. Our services are tailored to meet your specific needs, ensuring you get the support you need to thrive.

- Commitment to Excellence: Our dedication to providing high-quality services ensures that your financial records are always in expert hands.

“Partnering with Digital Tax Group means you can focus on what you do best—running your business—while we take care of your bookkeeping and accounting needs.”

At Digital Tax Group, we are more than just bookkeepers; we are your trusted advisors in accounting and bookkeeping. Ready to take your business to the next level? Schedule an appointment with us today and experience the difference of professional bookkeeping and accounting services.