Tax planning is essential for high-income earners looking to reduce their tax burden and maximize savings. With changes in federal income tax brackets and evolving tax rules, understanding the most effective tax strategies for 2025 is crucial. A well-structured tax plan can help individuals in higher tax brackets take advantage of deductions, lower their tax liability, and increase their financial efficiency.

Understanding High-Income Taxation

Federal Income Tax Brackets for High Earners

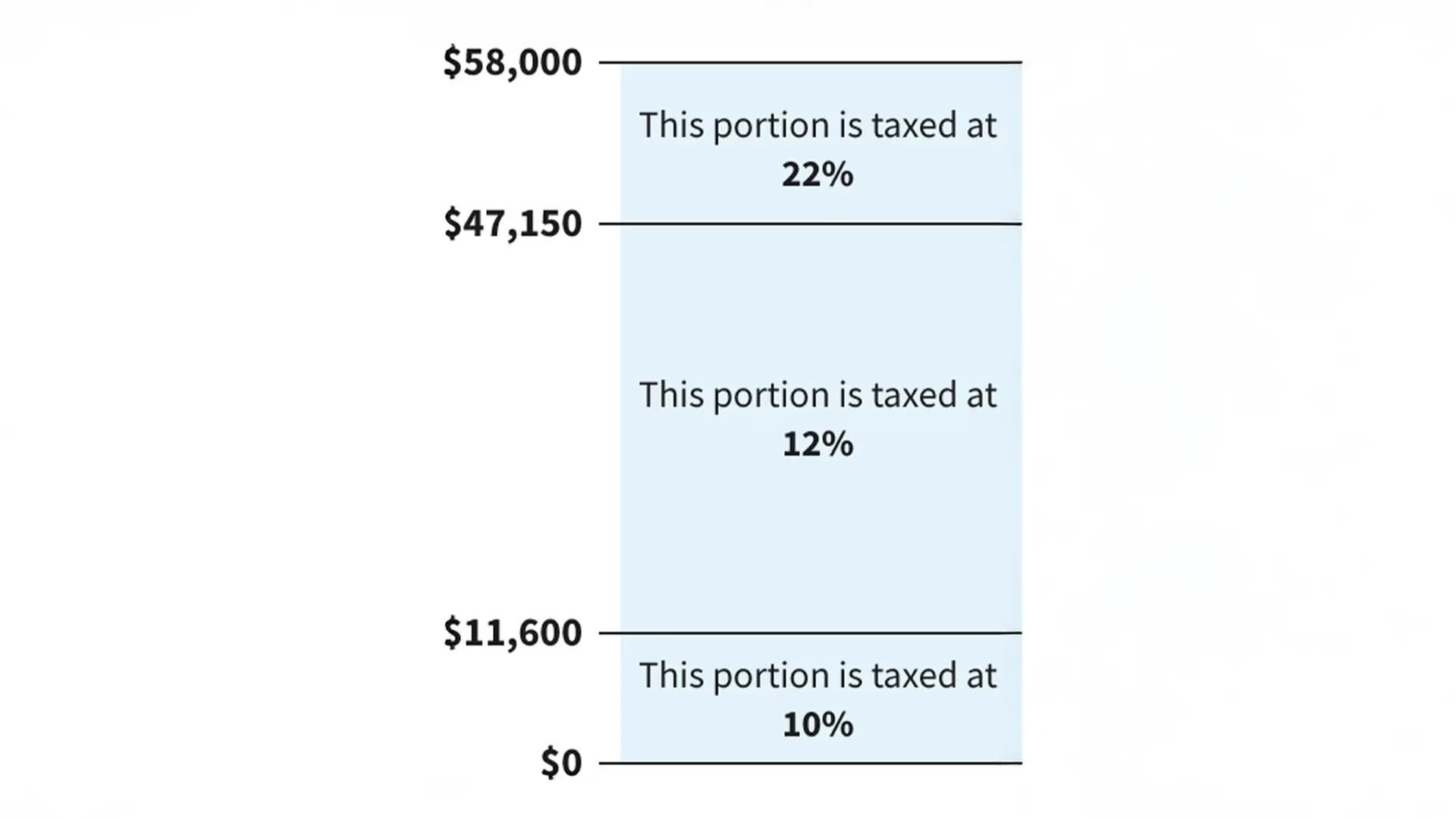

As tax laws evolve, high earners must stay updated on federal income tax brackets to ensure compliance and maximize tax savings. For 2025, the highest income tax rates remain a significant factor for individuals earning above certain thresholds. Knowing which tax bracket applies to your earnings can help you implement the right tax planning strategies to legally reduce taxable income.

Key considerations include:

- Identifying which federal income tax bracket applies to your earnings

- Understanding how tax deductions and credits affect taxable income

- Exploring ways to reduce the overall tax burden through effective tax strategies

Key Tax Rules for High-Income Individuals

The tax rules for high-income earners differ significantly from those applied to lower-income taxpayers. Higher tax rates mean increased exposure to taxes on investment income, business income, and capital gains tax. Additionally, certain tax benefits available to lower-income taxpayers phase out at higher income levels.

Important aspects to consider:

- Limitations on itemized deductions for high-income earners

- The impact of the alternative minimum tax (AMT)

- Changes in state income tax laws that affect high-income individuals

Navigating these regulations requires careful planning and a proactive approach to tax efficiency. Consulting with a professional like Ian Borbolla, CPA, Principal CPA at Digital Tax Group, can help ensure that you take full advantage of the available tax saving strategies.

Tax Planning Strategies for 2025

Ways to Reduce Taxable Income

For high earners, reducing taxable income is one of the most effective ways to lower their overall tax burden. Taking advantage of deductions, tax-advantaged investment accounts, and strategic financial moves can significantly impact the amount owed to the IRS.

Top strategies include:

- Maximizing contributions to retirement plans

- Utilizing business income deduction for self-employed individuals

- Investing in municipal bonds to benefit from federal tax exemptions

By leveraging tax-efficient strategies, high-income earners looking to maximize their savings can develop a comprehensive tax plan that aligns with their financial goals. To explore personalized tax strategies, schedule an appointment with Digital Tax Group today.

Investment Strategies for Tax Reduction

Capital Gains Tax and Investment Income

For high-income earners, investment income plays a significant role in overall financial planning. However, it also comes with tax implications, including capital gains tax. Understanding how to manage and minimize tax liability on investments is essential for long-term wealth accumulation.

Understanding Capital Gains Tax

Capital gains tax applies to profits from the sale of investments such as stocks, bonds, and real estate. There are two types:

- Short-term capital gains (held for less than a year) – Taxed as ordinary income, often at a higher tax rate

- Long-term capital gains (held for more than a year) – Typically taxed at lower rates, providing an opportunity to reduce the amount owed

Strategies to Reduce Investment Tax Liability

- Tax-Loss Harvesting – Offset gains by selling underperforming investments to minimize taxable income

- Holding Investments for Over a Year – Benefit from lower capital gains tax rates

- Investing in Tax-Advantaged Accounts – Utilize IRAs, 401(k)s, and Health Savings Accounts (HSAs)

- Municipal Bonds – Generate tax-free interest income at the federal tax level

By implementing these strategies, high-income individuals can take advantage of tax benefits and legally reduce taxable income.

Retirement Plans and Tax Advantages

Investing in retirement plans is one of the most effective ways for high-income earners to reduce their taxable income while preparing for the future. Contributions to qualified accounts can lower adjusted gross income, leading to significant tax savings.

Best Retirement Plans for High Earners

| Retirement Plan | Tax Benefit | Contribution Limit (2025) |

|---|---|---|

| 401(k) | Pre-tax contributions reduce taxable income | $23,000 ($30,500 for age 50+) |

| Traditional IRA | Contributions may be tax-deductible | $7,000 ($8,000 for age 50+) |

| Roth IRA | Tax-free withdrawals in retirement | $7,000 ($8,000 for age 50+) |

| SEP IRA | Ideal for self-employed individuals | Up to 25% of business income (max $69,000) |

Key Takeaways:

- Maximize Contributions – Higher limits on 401(k)s and IRAs allow for greater tax savings

- Consider Roth Conversions – Convert pre-tax accounts to a Roth IRA for tax-free growth

- Use SEP IRAs for Self-Employed Individuals – Ideal for entrepreneurs to lower business income taxes

To discuss personalized tax planning strategies, book a consultation with Digital Tax Group today.

Real Estate and Tax Reduction

Property Taxes and Deductions

For high-income earners, real estate investments can provide significant tax benefits, but they also come with property taxes and other obligations. Understanding how to leverage deductions and reduce overall tax liability is essential for effective tax planning.

Key Property Tax Considerations

- State and Local Taxes (SALT) Deduction – High earners can deduct up to $10,000 in state and local taxes, including property taxes.

- Depreciation Deduction – Rental property owners can claim depreciation, reducing business income taxes.

- Mortgage Interest Deduction – Allows eligible homeowners to deduct mortgage interest on qualifying loans.

Ways to Reduce Property Tax Burden

- Appeal Property Tax Assessments – Challenge overestimated home values to lower annual property taxes.

- Invest in Opportunity Zones – Reduce capital gains tax by reinvesting in government-designated areas.

- Consider Tax-Advantaged Real Estate – Utilize 1031 exchanges to defer capital gains tax.

Real estate remains a powerful tool for high-income individuals to create wealth while maximizing tax efficiency.

Tax Residency Considerations

For those seeking to minimize their tax burden, establishing tax residency in a state with lower income tax rates can be an effective strategy. Certain states offer significant tax savings for high-income earners.

States with No State Income Tax

| State | State Income Tax Rate |

|---|---|

| Florida | 0% |

| Texas | 0% |

| Nevada | 0% |

| Tennessee | 0% |

| Wyoming | 0% |

High earners relocating to low-tax or no-tax states can significantly reduce their taxable income. However, moving for tax benefits requires careful planning to meet tax residency requirements.

Key Considerations for Changing Residency:

- Spending at least 183 days in the new state to qualify for tax residency.

- Establishing driver’s licenses, voter registration, and home ownership in the new location.

- Avoiding continued financial ties to high-tax states to prevent dual taxation.

For expert guidance on tax rules related to residency, consult Digital Tax Group for professional tax assistance.

Compliance and Professional Tax Assistance

Importance of Professional Tax Preparation

Navigating high-income tax planning requires expertise and a proactive approach to managing tax liabilities. High earners face complex tax rules, and improper planning can lead to unnecessary tax exposure or missed opportunities for tax savings. Working with a seasoned professional ensures compliance while optimizing strategies to reduce taxable income.

“A well-structured tax plan isn’t just about reducing your current tax bill—it’s about securing long-term financial success.”

Why Work with a Tax Professional?

- Personalized Tax Strategies – Tailored tax planning strategies designed to fit your unique financial situation.

- Maximizing Deductions and Credits – Identifying every eligible deduction and credit to lower tax rates.

- Avoiding Costly Mistakes – Ensuring compliance with federal income tax brackets and avoiding IRS penalties.

- Business Tax Optimization – Strategic planning for self-employed individuals and business owners to reduce the amount of taxable business income.

To work with an experienced tax professional, contact Digital Tax Group or schedule a consultation today.

Schedule a Consultation

Planning ahead is critical for high-income earners looking to reduce taxes and protect their wealth. Whether optimizing investment income, managing property taxes, or restructuring business income, taking proactive steps now can make a significant difference.

For expert tax guidance, call Digital Tax Group or book an appointment to develop a personalized tax plan. Their team provides comprehensive tax planning strategies to help high earners navigate the complexities of federal income taxation effectively.