Choosing the right business structure is one of the most important decisions an entrepreneur will make between . If you’re trying to decide between an S-Corp vs Partnership, it’s crucial to understand the key differences between these two structures. Both offer pass-through taxation, but each has unique advantages and disadvantages.

In this post, we’ll break down the differences between an S-Corp and a Partnership, how each operates, their pros and cons, and the factors that should influence your decision. By the end, you’ll be better equipped to choose the best structure for your business.

What is an S-Corp?

An S-Corp, or S-Corporation, is a tax designation granted by the IRS. Unlike traditional corporations (C-Corps), S-Corps are not subject to corporate income tax. Instead, profits and losses “pass through” to the owners’ personal tax returns.

Key Characteristics of an S-Corp

- Limited Liability Protection: Shareholders of an S-Corp enjoy limited liability, meaning their personal assets are protected from business debts.

- Pass-Through Taxation: Profits and losses pass through to shareholders, who report them on their personal income tax returns, avoiding double taxation.

- Ownership Requirements: An S-Corp can have no more than 100 shareholders, all of whom must be U.S. citizens or residents.

- Corporate Formalities: S-Corps must adhere to formal corporate structures, including having a board of directors, annual meetings, and maintaining corporate records.

How an S-Corp Operates

Owners of an S-Corp are also known as shareholders. While an S-Corp has less flexibility than a Partnership in terms of how profits are allocated, it allows for tax-saving strategies, such as paying reasonable wages to owners. These wages are subject to payroll taxes.

Example of an S-Corp

Imagine a small consulting firm with three partners. If this firm is structured as an S-Corp, each partner would be required to take a reasonable salary based on their work in the company. The company’s profits would pass through to the owners’ personal tax returns after paying the required wages.

What is a Partnership?

A Partnership is a business structure where two or more people come together to share ownership, profits, and liabilities. Partnerships are relatively simple to form, and they don’t have many of the formal requirements that corporations do.

Key Characteristics of a Partnership

- Pass-Through Taxation: Similar to S-Corps, Partnerships are not taxed at the business level. Instead, profits and losses are passed through to the partners’ personal tax returns.

- Flexibility: Partnerships offer flexibility in terms of decision-making and profit distribution. There are no restrictions on the number or type of partners.

- Liability: General partners are personally liable for the debts and obligations of the business, whereas limited partners have liability protection.

How a Partnership Operates

A Partnership operates based on the partnership agreement, which outlines how profits and losses will be divided. There are no formal corporate requirements, which means decision-making is usually more flexible and informal than in an S-Corp.

Example of a Partnership

Consider a law firm where two attorneys operate as general partners. They share profits equally and are responsible for the firm’s debts. Since they don’t have the structure of an S-Corp, they are not required to pay themselves a wage, and all business profits are passed through to their personal tax returns.

Key Differences Between an S-Corp vs Partnership

Understanding the distinctions between an S-Corp and a Partnership can help you decide which structure works best for your business.

- Ownership and Structure

- S-Corp: Shareholders, who are limited to 100 individuals and must be U.S. citizens or residents.

- Partnership: Partners (two or more), with no limitations on the number of partners or their citizenship.

- Taxation

- S-Corp: Pass-through taxation with the added requirement that owners must take reasonable wages, subject to payroll taxes.

- Partnership: Pass-through taxation with no requirement to pay wages to partners.

- Liability

- S-Corp: Shareholders enjoy limited liability protection.

- Partnership: General partners have personal liability for business debts, whereas limited partners have limited liability.

- Required Formalities

- S-Corp: Must adhere to corporate formalities, including holding annual meetings and maintaining bylaws.

- Partnership: Minimal formalities and no required corporate structure.

- Wages and Distributions

- S-Corp: Owners must pay themselves a reasonable salary, subject to payroll taxes.

- Partnership: Partners take distributions of profit based on the partnership agreement, without paying themselves a wage.

- Self-Employment Taxes

- S-Corp: Only wages are subject to self-employment taxes.

- Partnership: The entire share of profit is subject to self-employment taxes.

Pros and Cons of an S-Corp

Pros of an S-Corp

- Limited Liability: Shareholders are not personally liable for business debts.

- Tax Savings: S-Corp owners can reduce self-employment taxes by receiving a reasonable salary and taking the rest of the profits as distributions.

- Ability to Raise Capital: S-Corps can issue stock to raise capital.

Cons of an S-Corp

- Administrative Requirements: S-Corps must follow formalities, such as holding annual meetings and keeping corporate minutes.

- Limited Shareholders: An S-Corp can have no more than 100 shareholders, all of whom must be U.S. citizens or residents.

- Reasonable Wage Requirement: Owners must pay themselves reasonable wages, which are subject to payroll taxes.

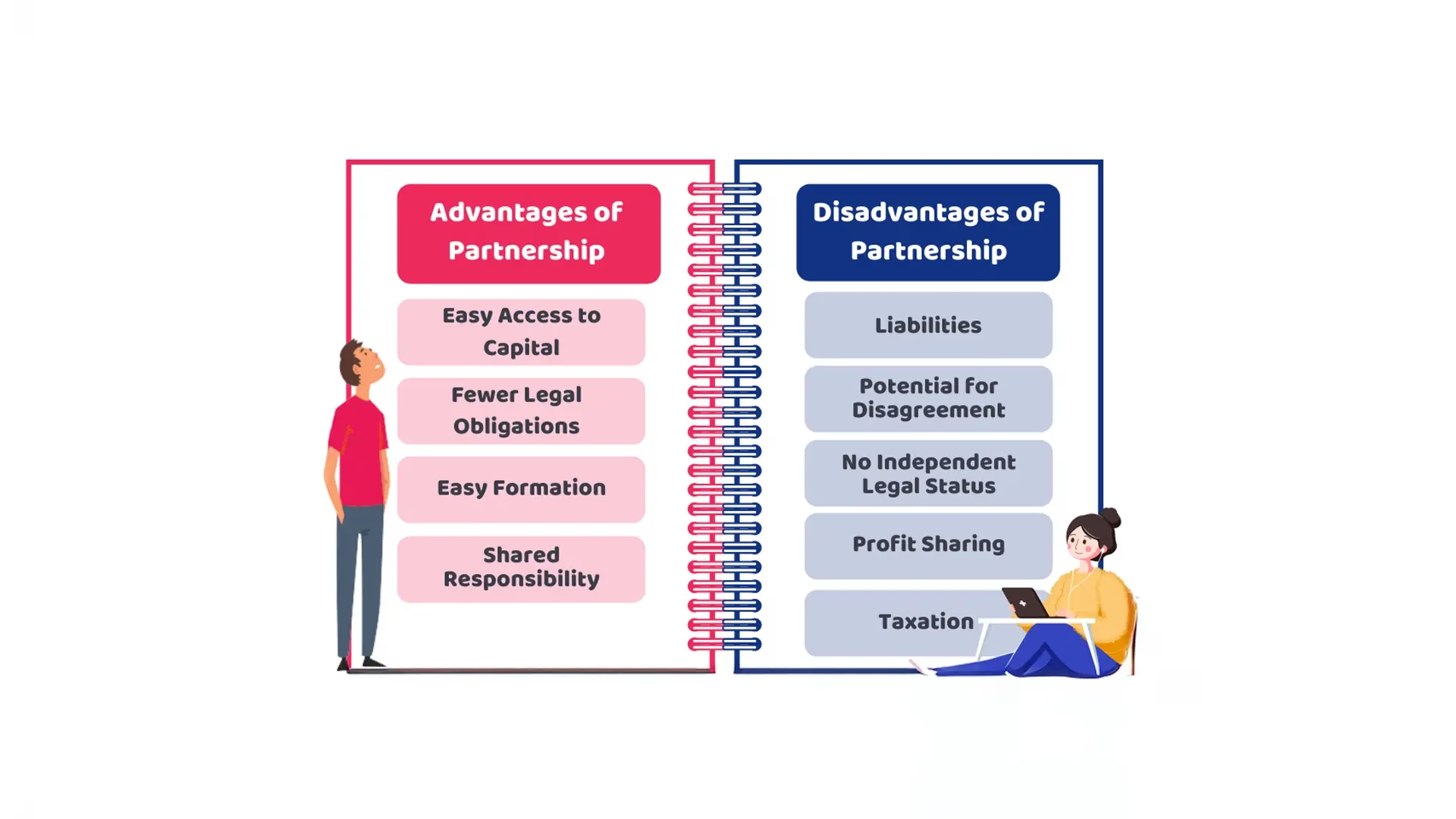

Pros and Cons of a Partnership

Pros of a Partnership

- Flexibility: Partnerships are easy to form and allow for flexible profit-sharing arrangements.

- No Corporate Formalities: There’s no need for a board of directors or annual meetings.

- Pass-Through Taxation: Like an S-Corp, partnerships enjoy pass-through taxation.

Cons of a Partnership

- Personal Liability: General partners are personally liable for the business’s debts and obligations.

- Self-Employment Taxes: All of the business’s profits are subject to self-employment taxes.

- Limited Ability to Raise Capital: Partnerships cannot issue stock, making it harder to raise large amounts of capital.

Which Structure is Best for Your Business?

When choosing between an S-Corp and a Partnership, you should consider factors like the size of your business, your tax situation, and your long-term goals. An S-Corp may be best for businesses that want to limit liability, have a small group of shareholders, and want to save on self-employment taxes. On the other hand, a Partnership may be a better option for those who prefer flexibility and simplicity in their business structure.

Conclusion – S-Corp vs Partnership

Choosing between an S-Corp and a Partnership depends on your business needs, goals, and structure preferences. If you’re looking for limited liability and tax-saving opportunities, an S-Corp might be the way to go. However, if you prefer a more flexible, informal structure, a Partnership could be a better fit.

If you’re still unsure which structure is best for your business, request a consultation with a CPA from Digital Tax Gorup who can help you make the right decision.