Tax filing inflation impact 2024 continues to affect the economy, and understanding its effects on tax filing is crucial for taxpayers. Inflation adjustments can significantly alter tax brackets and credits, influencing how much individuals and businesses owe to the IRS. In this post, we’ll explore the 2024 tax brackets and credits that have been adjusted for inflation, helping you navigate these changes effectively.

Understanding Inflation and Its Measurement

Definition of Inflation

Inflation refers to the general increase in prices and fall in the purchasing power of money. It affects everything from grocery bills to housing costs, and its implications extend to tax policies as well.

Measurement of Inflation

Inflation is typically measured by the Consumer Price Index (CPI), which tracks changes in the price level of a basket of consumer goods and services over time. Understanding CPI helps taxpayers grasp how inflation affects their tax obligations.

Historical Context

In the past, inflation has prompted significant adjustments in tax policies. For instance, during periods of high inflation, the IRS has made changes to tax brackets to prevent “bracket creep,” where taxpayers find themselves in higher tax brackets due to inflation rather than actual income increases.

Inflation Adjustments for 2024 Tax Brackets

Overview of Tax Brackets

The federal tax system uses a progressive tax structure, meaning that different portions of income are taxed at different rates. Understanding these brackets is essential for effective tax planning.

Adjustments for 2024

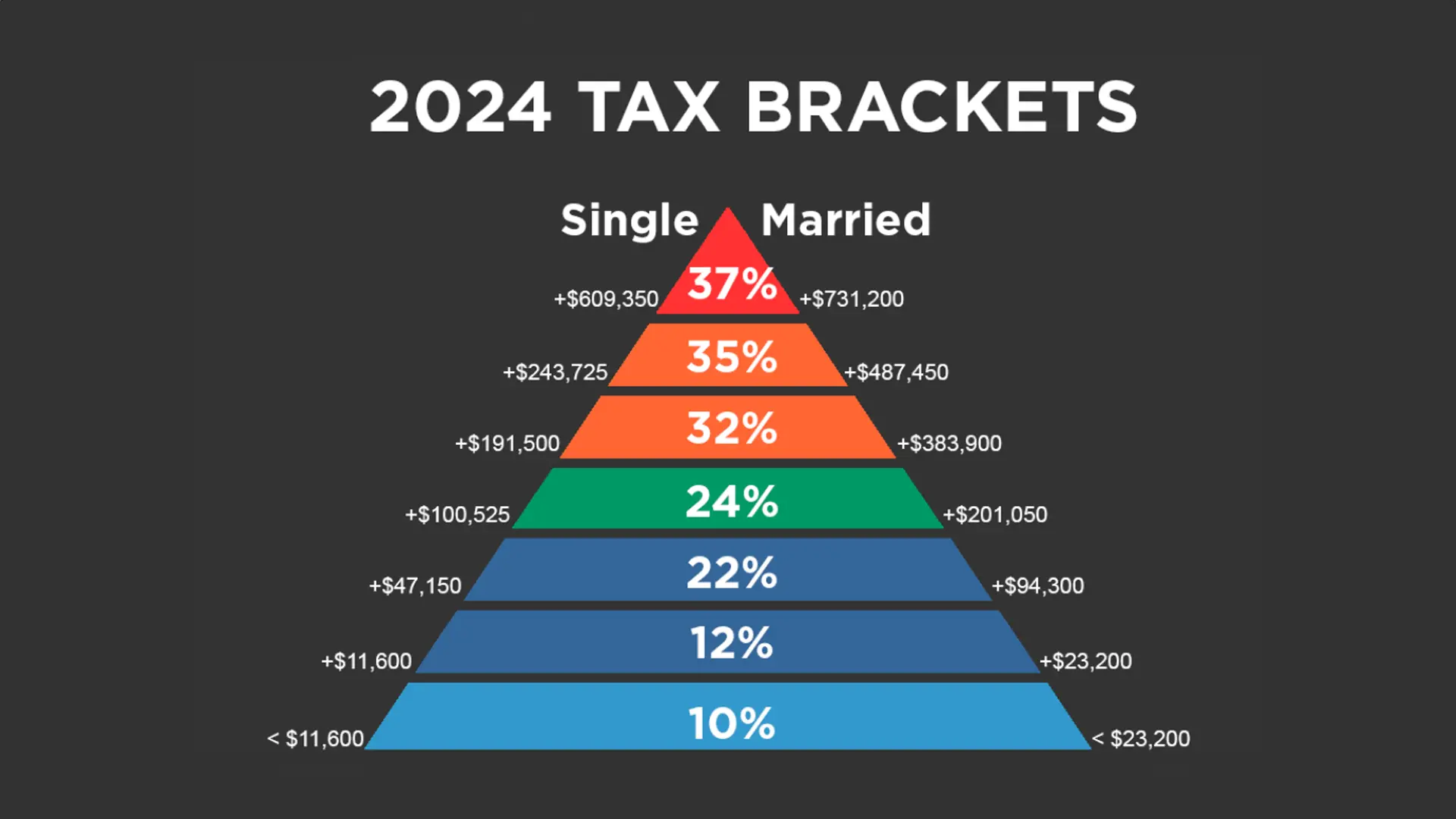

For the 2024 tax year, the IRS has announced several adjustments to tax brackets due to inflation. Here are the updated tax brackets for 2024:

- 10%: Income up to $11,600 for single filers; $23,200 for married couples filing jointly.

- 12%: Income over $11,600 up to $47,150 for single filers; over $23,200 up to $94,300 for married couples.

- 22%: Income over $47,150 up to $100,525 for single filers; over $94,300 up to $201,050 for married couples.

- 24%: Income over $100,525 up to $191,950 for single filers; over $201,050 up to $383,900 for married couples.

- 32%: Income over $191,950 up to $243,275 for single filers; over $383,900 up to $487,450 for married couples.

- 35%: Income over $243,275 up to $609,350 for single filers; over $487,450 up to $731,200 for married couples.

- 37%: Income over $609,350 for single filers; over $731,200 for married couples.

Tax Filing Inflation Impact 2024 on Taxpayers

These adjustments mean that taxpayers may pay lower taxes than in previous years, provided their income hasn’t increased significantly. By understanding these brackets, individuals can plan their finances more effectively. For deeper insights on planning strategies, check out our post “The 7 Best Tax Strategy and Tax Planning Tips for 2024”.

Changes to Tax Credits Due to Inflation

Overview of Tax Credits

Tax credits reduce the amount of tax owed on a dollar-for-dollar basis. They can significantly lower tax liability, making them an essential aspect of tax planning.

Inflation-Adjusted Credits for 2024

Several key tax credits have been adjusted for the 2024 tax year, reflecting inflation:

- Child Tax Credit: The credit has increased to $2,000 per qualifying child, up from $1,500 in 2023.

- Earned Income Tax Credit (EITC): The maximum EITC for 2024 will be $7,430 for taxpayers with three or more qualifying children, up from $7,130 in 2023.

- Lifetime Learning Credit: The maximum credit will rise to $2,500 for qualified education expenses.

Eligibility Changes

These adjustments may also impact eligibility. For example, families with higher incomes might find themselves qualifying for credits they previously did not. For additional insights on managing business finances and tax planning strategies, you can reference “Outsourced CFO – Elevate Your Business with Expert Financial Services”.

Planning Strategies for Taxpayers

Advice for Tax Planning in 2024

To make the most of these adjustments, consider the following tips:

- Income Management: Be mindful of income levels that could push you into a higher tax bracket. Consider strategies like deferring income or maximizing retirement contributions.

- Maximizing Tax Credits: Review your eligibility for available credits and ensure you’re claiming all that you qualify for. Consult tax software or a professional for guidance, such as a CPA Miami – Expert Tax Accountant.

- Importance of Consulting a CPA: Navigating complex tax laws can be challenging, especially with ongoing changes. Consulting a CPA ensures you have a customized strategy to optimize your situation in 2024.

Conclusion

Inflation plays a crucial role in shaping tax policy, affecting both brackets and credits for the 2024 tax year. By understanding these changes, taxpayers can better prepare and optimize their tax filings. For personalized advice, don’t hesitate to consult a CPA, to ensure you make the most of your tax situation.